- #Income and expenses worksheet how to#

- #Income and expenses worksheet full#

- #Income and expenses worksheet plus#

The custodial parent is expected to pay a certain portion of those expenses.There are extenuating circumstances for everything, of course. Child support is not intended to pay 100% of a child's needs. Generally, they cannot force your co-parent into poverty because you have to go to work now and your child needs full-time childcare. A judge can actually order you to either cough up the extra money for the child care, or find a cheaper child care.

#Income and expenses worksheet full#

So if the custodial parent moves in with someone, then the custodial parent may now have to pay a full $1500, because the benefits they are receiving from sharing their living expenses works out to be approximately $390.Of course, this is all hypothetical. The primary goal of Child Support is to make sure that the children maintain the same standard of living as if both parents were still together.If either parent remarries, or moves in with someone, then the new partner’s income cannot be counted, but there can be an additional burden on that parent's portion of the expected child expenses, because they are getting benefits from sharing their living expenses with another person. So they would pay $1890 to the other parent, and the custodial parent would be expected to pay $1, 110 toward the care of the children.Frankly, the federal government has all kinds of rules about how the paying of Child Support cannot put the non-custodial parent below the federal poverty line unless they were already there. So if the non-custodial parent spends at least 90 overnights per year with the kids, in my area, then they get a 10% reduction on the child support they have to pay, to help offset their costs during their time with children.

So the person with the 3K is responsible for 30% of that, or $900, and the person with the 7K is responsible for 70% of that, or $2,100.Now, lots of States take into account how much time each parent spends with the kids.

So then, the person with the 3K makes 30% of the child support, and the person with the 7K make 70%.The federal healthcare administration has a worksheet that says for a family with two children, and the parents make 10K combined, you would expect each child to receive (maybe, rough numbers for the sake of Simple math) 1.5K in support, so 3k total for both kids. You average the three years of income for both, say it works out to 3k and 7k (most people make way more than that, this is just to show the simple math). You plug in daycare costs, and if you or your ex pay child support for any other kids.

#Income and expenses worksheet plus#

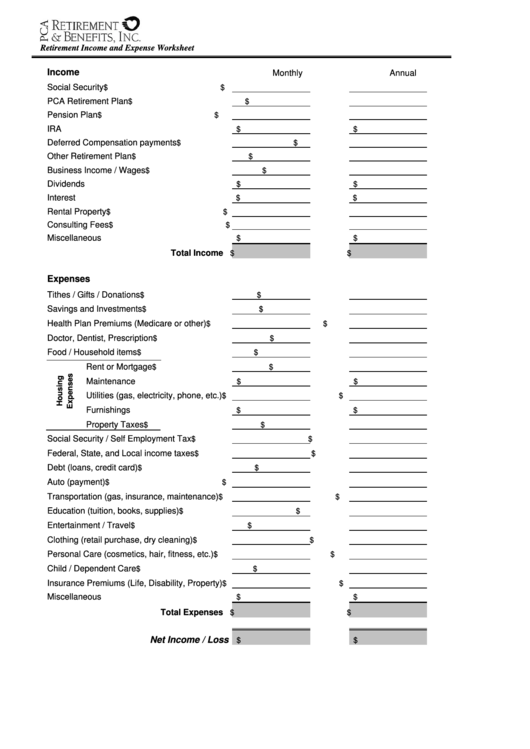

You plug in what you would pay for health insurance for yourself and for yourself plus kiddos, same for your ex. You plug in your income for the last three years and bonuses and raises and commissions and you plug in your ex's data. So I don't know what State/county you're in, but most of the places I have lived, the county has a child support worksheet online to help you estimate child support. I feel that 1/2 of childcare and a little extra to help pay for basic needs is fair, right? I got a raise.Good Luck! Is $900 a reasonable amount for child support? Full time childcare alone is $1440. My children’s childcare costs went down because they got into the next higher kid to teacher ratio classes. I was no longer adding more fees to my legal balance. I was permitted to move and sell the house. The fifth, which only happens every third month, was for everything else.That only lasted for a year. My third paid the mortgage and real estate taxes. My second paid the health insurance and daycare. The first week covered my income and payroll taxes. I felt like I lived paycheck to paycheck. There are some templates available in the appendix that you can photocopy or use to model your budget using pencil and paper.When I first went back to work after my second child was born I was in the midst of a divorce.

#Income and expenses worksheet how to#

Total Money Makeover is a how to book with some good advice for getting ahead of the paycheck to paycheck lifestyle. With your pay stub in hand, fill out the worksheet.Go to your local library and check out some books on budgeting. There is a withholding calculator on irs. If you get paid every other week and pay rent every month, save half the month’s rent from today’s check just for rent.Check that your withholding is correct.

If this paycheck is typical, multiply it by the number of pay periods in a year to find your annual income monthly rent times 12 etc.Make a plan for this paycheck that includes saving towards this month’s expenses and the next six months or so of expenses. My recommendation is to take a longer term approach with the next paycheck.Write out your annual expenses and income.

0 kommentar(er)

0 kommentar(er)